PARTS OF CHEQUEBOOK HOW TO

The routing number is another tracing element printed on the cheque to help the drawee understand where and how to find the funds specified on the leaf.

PARTS OF CHEQUEBOOK VERIFICATION

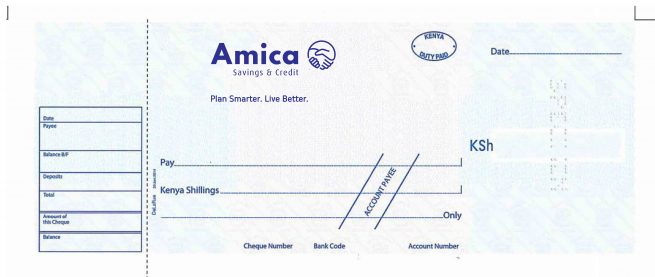

Bank Details and LogoĪll relevant information indicating the bank name, bank logo, branch number, address, etc., are all printed on the cheque leaf for authentication and verification purposes. The drawer’s approval is bestowed upon the payee to receive the specified amount. It is the most important field that the drawer must fill. The signature line element is the verification element of the cheque. The cheque leaf cannot be encashed post the date mentioned on the cheque. The dateline is filled by the drawer to ensure there is a fixed timeline for the payee to encash the cheque. There is additional space in case the drawer wants to add some notes or instructions on the cheque leaf. This field contains the numerical value written in the currency box in words. This is a mandatory element that is filled by the drawer. The currency box element shows how much money is transferred to the payee. Interestingly, the drawer can be the payee as well. This is the designated area on the cheque to show who receives the money. The payee line is an element that has to be filled by the drawer of the cheque. Most cheques issued today have the ease of a barcode to retrieve information as quickly as possible. It could be simply printed on the cheque or could be printed along with a barcode. Personal InformationĪ bank cheque leaf provides essential information regarding the owner of the cheque, the account number of the holder, and the bank details like a branch, location, etc. Here are some important elements of a bank cheque leaf: 1. Although it ensures complete no-cash transactions, most individuals have adopted digitization, where payments are made through banking applications. However, the transfer of money remains the point of commonality and purpose. There are different types of cheques that do different things.

Additionally, transfers with cheque leaves help you to keep track of all your transactions. Cheques are majorly used as it is a safer alternative to in-hand handling of money. What is the Purpose of a Cheque Leaf?Īs mentioned above, a cheque is an instrument that allows you to transfer money from one account to another without physically handing over money. Cheque leaves are vehicles for monetary exchange and are developed to enable smooth and easy financial transactions that are safe and secure. The payee and drawer could be an individual, bank, institution or even a business.

The one who receives the money is called a Payee, the one who has written the cheque is the Drawer, and the Payee’s bank is called Drawee. Every cheque leaf instructs a bank or NBFC to pay the amount indicated in the cheque to the payee’s name mentioned on the cheque. You can use a cheque leaf to withdraw, deposit or transfer money from one account to another. What is a Cheque Leaf?Ī single cheque from a chequebook is called a cheque leaf. In this blog, we will discuss essential details of a cheque leaf, such as its purpose, features and the guidelines that payers/payees need to abide by. Similarly, multiple cheques are called cheque leaves.

A single cheque in one’s chequebook is termed as a cheque leaf. Before the advent of electronic payment systems, bank cheques were the most popular form of non-cash payment.

0 kommentar(er)

0 kommentar(er)